Ihr Warenkorb ist gerade leer!

Whitepaper Adjacencies

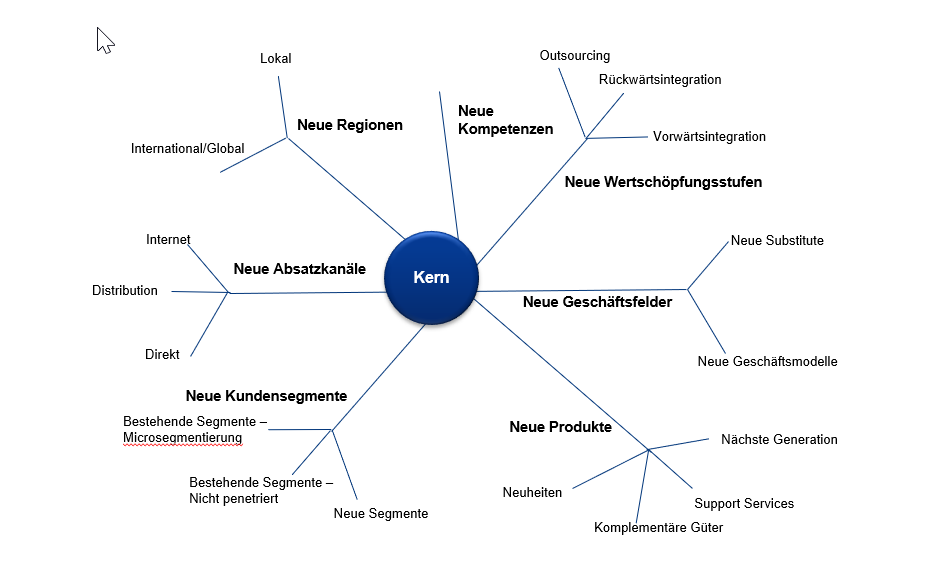

The Adjacency method is based on a similar philosophy to the Ansoff matrix, but uses additional criteria. While the Ansoff matrix works with the dimensions product and market, the Adjacency method focuses on the dimensions distance to the core business and distance to success.

For the distance to the core business we take the two Ansoff criteria market and product and add the criteria technology, sales channel, regions, value chain (forward and backward integration) and applications.

For the dimension of distance to success, we work with criteria such as the level of necessary investment or duration until the first turnover.

Since the risk, and thus the probability of failure, increases with the distance to the existing business, the following rules apply:

- Develop new businesses in neighboring (adjacent) areas

- Do not develop new businesses in more than one dimension at the same time (for Ansoff, that would be diversification)

Figure 1: Expansion of the core business in multiple dimensions

The procedure is organized in the following steps:

- Definition of the core business

- Defining the criteria for the distance from the core business (Adjacency)

- Definition of criteria for the distance to success

- Development of strategic options (the marketplace method is suitable for this)

- Rating of adjacencies and distance to success for each strategic option

- Calculating the Adjacency Portfolio (see Excel Tool)

- Selection of options and development of strategic directions

Procedure:

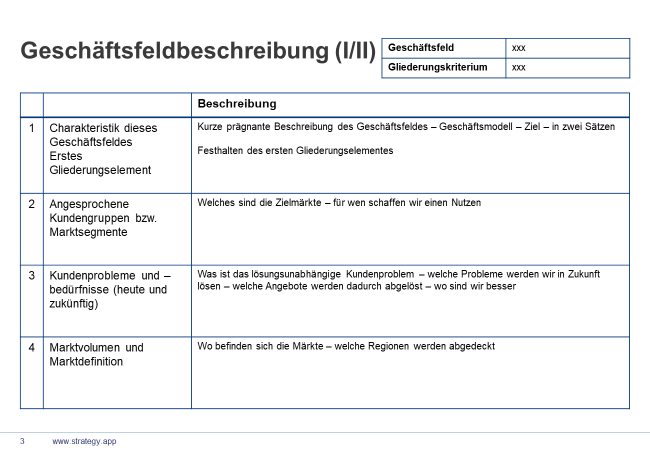

1. Definition of the core business

In a first step, the core business is defined by the description of the business segments. You will find instructions on how to do this in the two whitepapers «Business Segment Structure» and «Business Segment Description».

Figure 2: Business Field Description

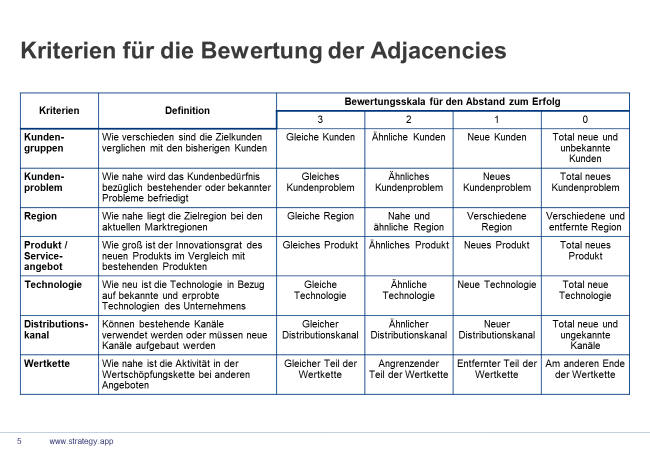

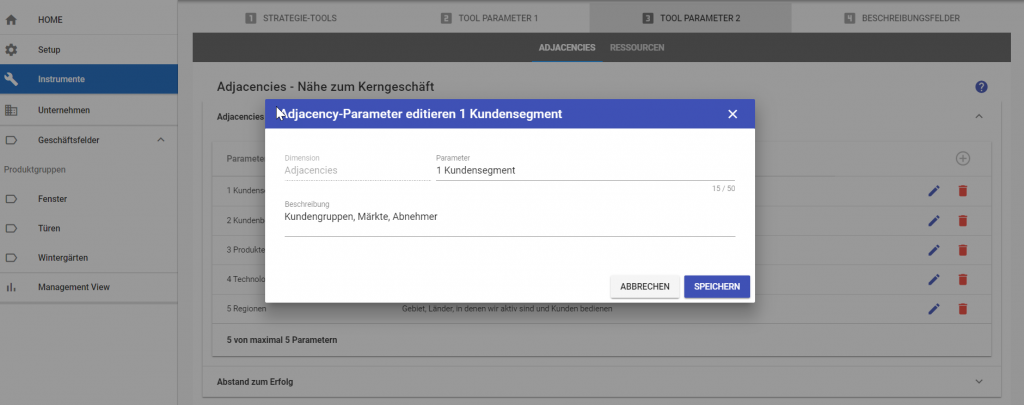

2. Defining the criteria for the distance from the core business (Adjacency)

The criteria market / customer groups, products, technologies, sales channels and regions help us to measure the distance to our core business. If all are the same, we remain in our core business – the more of them are different, the further we move into new areas of business.

These criteria must be discussed, precisely defined and provided with a scale of values, e.g. with values from 1 to 3, which indicate the distance from the core business.

Figure 3: Definition of criteria for the dimension Adjacency

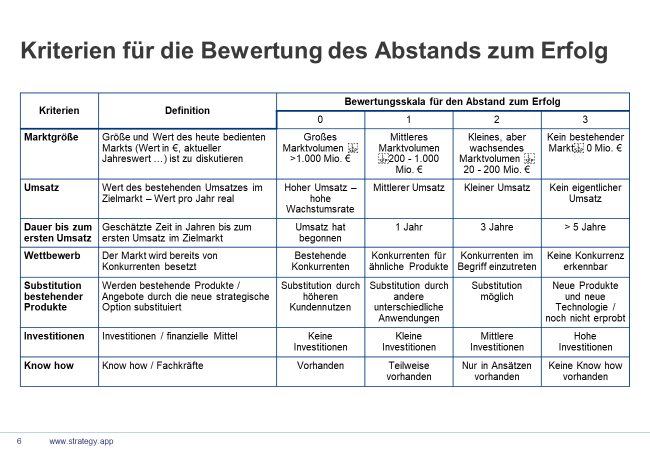

3. Definition of criteria for distance to success

Here we propose the following six criteria: Market size – Sales – Time to first sales – Competition – Substitution of existing products – Investments

These criteria should also be discussed, defined and provided with a scale of values, e.g. the expected market volume is evaluated with figures from 1 to 3.

Figure 4: Description of the criteria for the distance to success

4. Developing Strategic Options

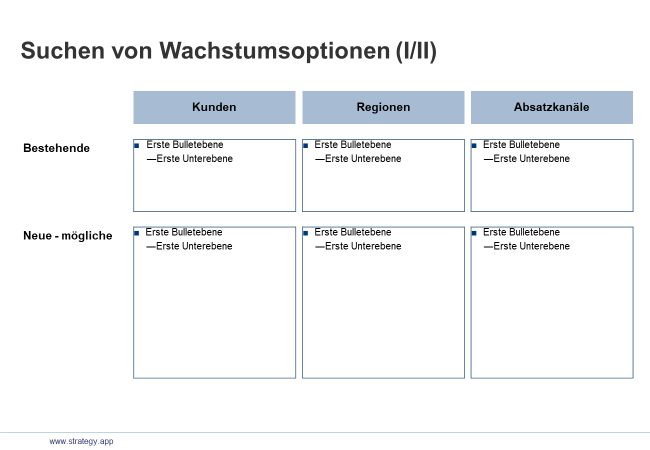

For the elaboration and compilation of strategic options and directions, we recommend the «Marketplace» method (we will also provide a whitepaper on this shortly). However, other methods can also be used here, such as brainstorming or systematic derivation from SWOT analysis. Or we can use simple forms to search for potentials in any direction (dimension).

Figure 5: Developing strategic options

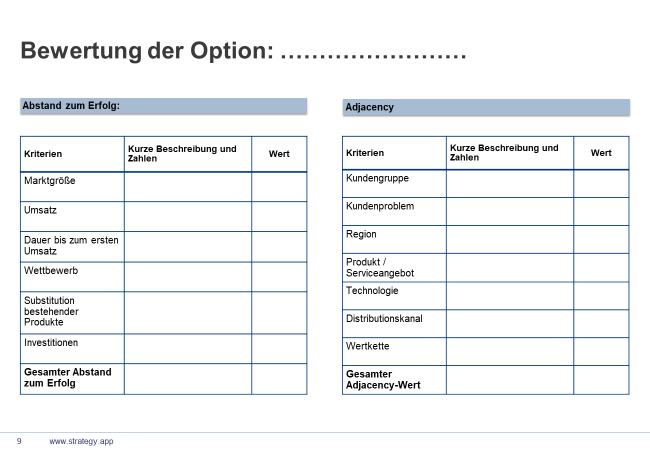

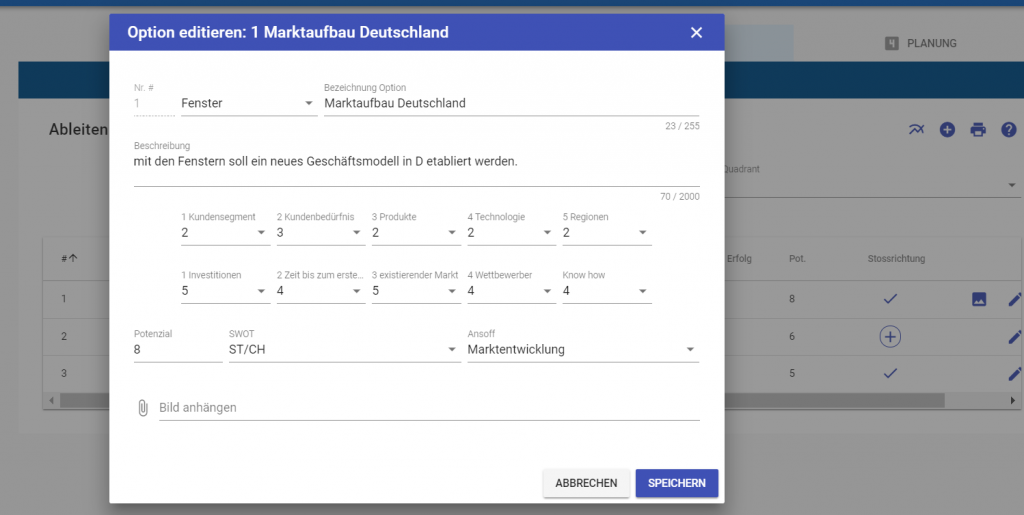

5. Assessment of adjacencies and distance to success for each strategic option

For each idea or option, the distance to the core business and the distance to success are evaluated based on the given criteria. A brief description of the discussion will help with later use or revision.

Figure 6: Assessment of the strategic options

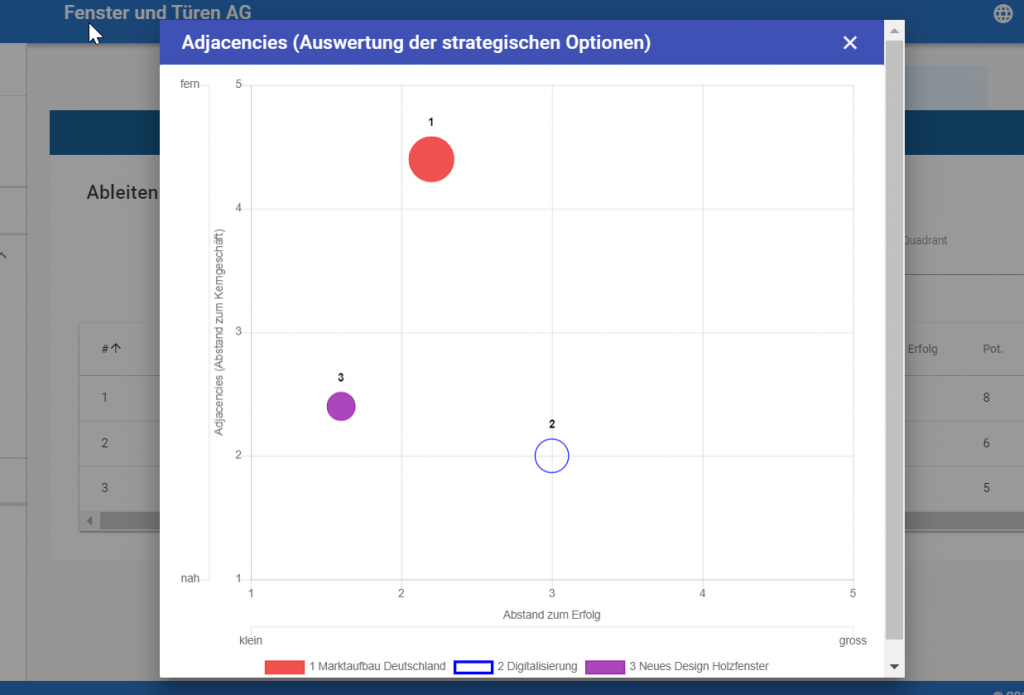

6. Calculating the Adjacency Portfolio (see Excel Tool)

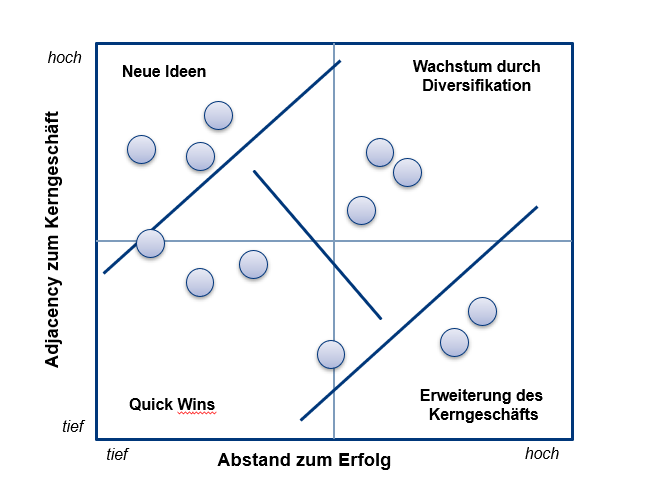

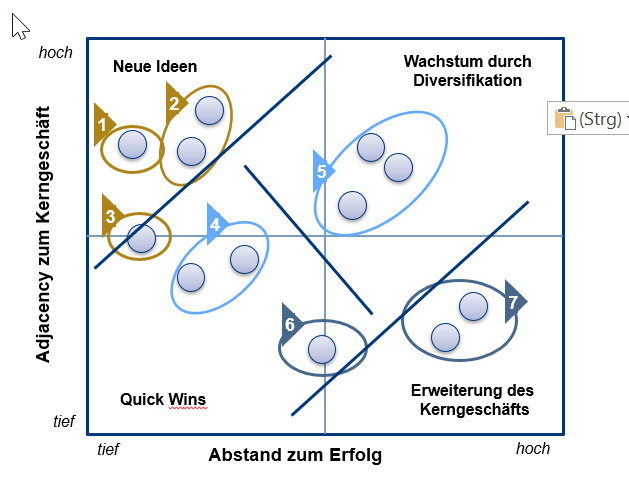

We provide you with an Excel tool for calculating the portfolio. The result shows at a glance the risk positions of the individual options, from the expansion of the core business to diversification which is totally different from the existing business.

Figure 7: Rating of options (Excel tool or directly in STRATEGY.APP)

7. Selection of options and description of strategic directions

The risk portfolio can be used to divide up and prioritise the strategy directions.

The matrix can be roughly divided into 4 fields:

- Close to the core business and close to success (bottom left):

- These are the Quick-Wins. They can be implemented quickly and are in the core business. Often these are not big strategies, but rather immediate measures.

- Close to the core business, but big distance to success (bottom right):

- This is the strategic expansion of the core business. New, partly large and therefore strategic investments in the existing business. This includes, for example, the construction of a new factory.

- Far from the core business with a small distance to success (top left):

- These are often ideas for new business in the form of tests or pilot projects. Sometimes the effort is simply underestimated here. Nevertheless, it may be useful to launch targeted experiments or to try something without investing too much. This allows the risk to be kept under control.

- Far from the core business with a big distance to success (top right):

- This is real diversification. This not only involves a high risk, but also has a considerable cost. We recommend that you take another close look at these options and only tackle them after weighing up all the risks and arguments.

The preparation of a business plan and a risk assessment can now be built on this basis.

Assessment of strategic options with Adjacency in STRATEGY.APP

In STRATEGY.APP, the criteria for the Adjacencies tool are set in the parameters for the instruments:

Figure 9: Input of the parameters for Adjacency

The strategic options that we have developed are therefore evaluated individually:

Figure 10: Rating of the individual options

The evaluation shows the position of the options on the adjacency matrix:

Figure 11: Position of the options on the adjacency matrix

Then the options for further processing are selected and described and quantified as strategic directions.

Note: Agility

Here is a note on the subject of agility: STRATEGY.APP allows new options to be added at any time, and new directions to be created from the options. On the other hand, running strategic directions can be stopped or reset at any time. The business plan and the measures are then automatically adjusted or removed. This makes it possible to react to changes in the environment at any time.

We have prepared a practical tool (xls) and a template for PowerPoint for you to download:

Download Adjacenciy example (xlsx)

Download Adjacency PPT Template

Schlagwörter:

Schreiben Sie einen Kommentar